It’s always good to be remembered for the things you accomplish in life, right? Less so if those accomplishments include international media outlets dubbing you the ‘World’s Worst Central Banker’, plus now a jail stint in Lebanon.

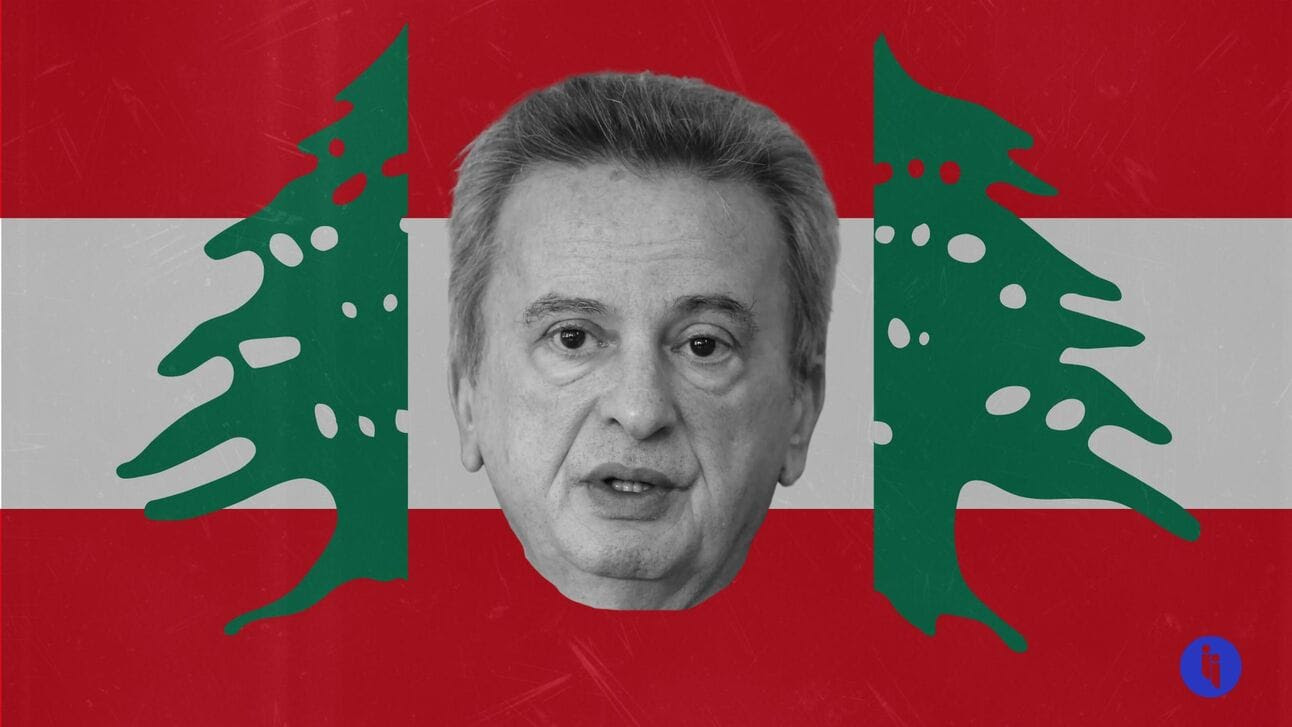

On Tuesday, authorities arrested Lebanon’s ex-central bank chief Riad Salameh in Beirut and charged him with the embezzlement of $42M.

Riad and his brother Raja are known to investigators everywhere.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

In fact, there must be faded photos of the duo pinned to corkboards in at least seven Western capitals, where we assume grizzled investigators with complex backstories have been taking long drags on cigarettes while figuring out how these two brothers hid up to $300M across a maze of international bank accounts. France and Germany even issued warrants for Riad’s arrest last year, and the US, UK and Canada have all slapped sanctions.

But who exactly is Riad Salameh?

Son of a hotelier, he studied at the American University of Beirut before making a name for himself at US investment bank Merrill Lynch. There, he got to know a certain Lebanese businessman, Rafic Hariri, and began managing his portfolio.

Rafic Hariri. Does that name ring a bell?

Hariri went on to become Lebanon’s prime minister after the country’s civil war, and when he needed to appoint a central bank governor, it turns out he knew a guy: Riad Salameh. Hariri was later assassinated (a UN-backed probe blamed Hezbollah), but Salameh stayed on as central bank chief from 1993 until 2023!

And when reflecting on such a marathon innings, the classic Batman quote comes to mind: “You either die a hero or you live long enough to become the villain”.

Salameh initially earned cred for stabilising the country’s economy. There were even fan-boys at the IMF during the 2008 global financial crisis, with one senior official there marvelling, “you could have thought [Salameh] had a crystal ball”.

But did the good times last? No, dear Intriguer, they did not. A crisis started engulfing the Lebanese economy from 2019, plunging millions into poverty:

- Lebanon’s economy has since halved

- Inflation peaked at 269% last year (it’s still around 35% now)

- The lira has lost 98% of its value, and

- Desperate folks even started robbing banks… to get their own money.

How’d it get so bad? The short answer is a healthy mix of ineptitude, corruption, and intrigue. The slightly longer answer is that Lebanon had been borrowing beyond its means, lost crucial Gulf support due to Iran’s hold on Hezbollah (and Hezbollah’s hold on Lebanon), and then faced a severe liquidity crisis.

So from 2016, Salameh started luring fresh US dollar deposits with the promise of sky-high returns. This seemed to work on paper, if not for the exorbitant amounts the Lebanese central bank now owed its depositors. But instead of then reining in spending, politicians doled out big pay rises ahead of the 2018 election, and later tried to balance the books with a tax on (among other things) WhatsApp calls!

The sheer absurdity of the idea, coupled with a long-held sense of outrage at a system favouring the elites, triggered mass protests and plunged the country into a political and economic crisis that still persists today.

And so now, let’s close with another classic quote, this time from Warren Buffett: “Only when the tide goes out do you discover who’s been swimming naked.”

Yes, dear Intriguer. As Lebanon’s tide has receded, the astonishing allegations suggest Riad Salameh wasn’t even wearing sunblock.

INTRIGUE’S TAKE

Like many of the folks running Lebanon lately, Salameh was long seen as untouchable. Even as all the accusations piled up, it was hard to see anything ever actually happening.

So then… what changed? Well this is just a temporary detention for now, so maybe nothing will change in the end.

But also… we couldn’t help but notice that the world’s main financial crimes watchdog (FATF) just started threatening to add Lebanon to its money laundering ‘grey list’. And one of the factors that FATF weighs up in this process is whether countries are properly prosecuting financial crimes.

Now, Lebanon already has a tough recovery ahead, but it looks impossible if it gets grey-listed by FATF (your list of willing business partners really shrinks).

So it wouldn’t surprise us if Beirut was now throwing Salameh under the FATF bus to avoid a grey-listing. Whatever the reason, Lebanon’s people will be happy to see a dash of accountability.

Also worth noting:

- Prosecutors are also saying Salameh was using elaborate financial chicanery to hide vast losses caused by his reckless monetary policies. Salameh denies the charges, and says he got wealthy from his Merrill Lynch days, plus a bit of family money.

- Oh, and speaking of central bankers in trouble: Libya’s central bank chief has now fled to Turkey, after finding himself at the centre of a power struggle between the two rival regimes now running Libya.