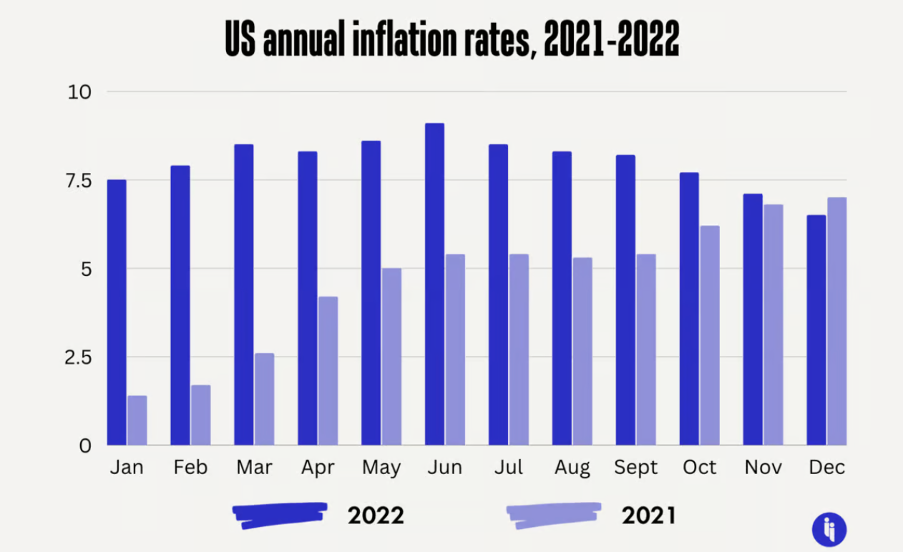

Briefly: We open the week with some good news! The US’s inflation rate fell for the sixth consecutive month to 6.5% in December, the lowest rate in over a year. Inflation still has a long way to fall to reach the Federal Reserve’s 2% target, but December’s data suggests that interest rate hikes are working.

There are other cautiously optimistic signs for the global economy:

- Energy prices have retreated from their March 2022 peak.

- The world’s second-largest economy, China, is abandoning its growth-crushing Covid lockdowns.

- Pandemic-related supply-chain bottlenecks have mostly cleared up.

Consumer expectations are improving, too. And, as the value of the US dollar weakens, countries around the globe are enjoying cheaper credit and commodities. What’s not to love?

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

Intrigue’s take: We hate to be a buzzkill, but the World Bank thinks the global economy is in for a tough time in 2023: “in virtually all regions of the world, per-capita income growth will be slower than it was during the decade before COVID-19.”

The story isn’t much better over at the IMF, where Managing Director Kristalina Georgieva expects “one-third of the world economy to be in recession” this year. Did we say we’re opening the week with good news? Whoops!

Also worth noting:

- The Fed has promised to continue raising interest rates beyond current market expectations.

- The US dollar doesn’t weaken easily: according to the ‘dollar smile’ theory, greenbacks will continue to appreciate against other currencies even in a recession.