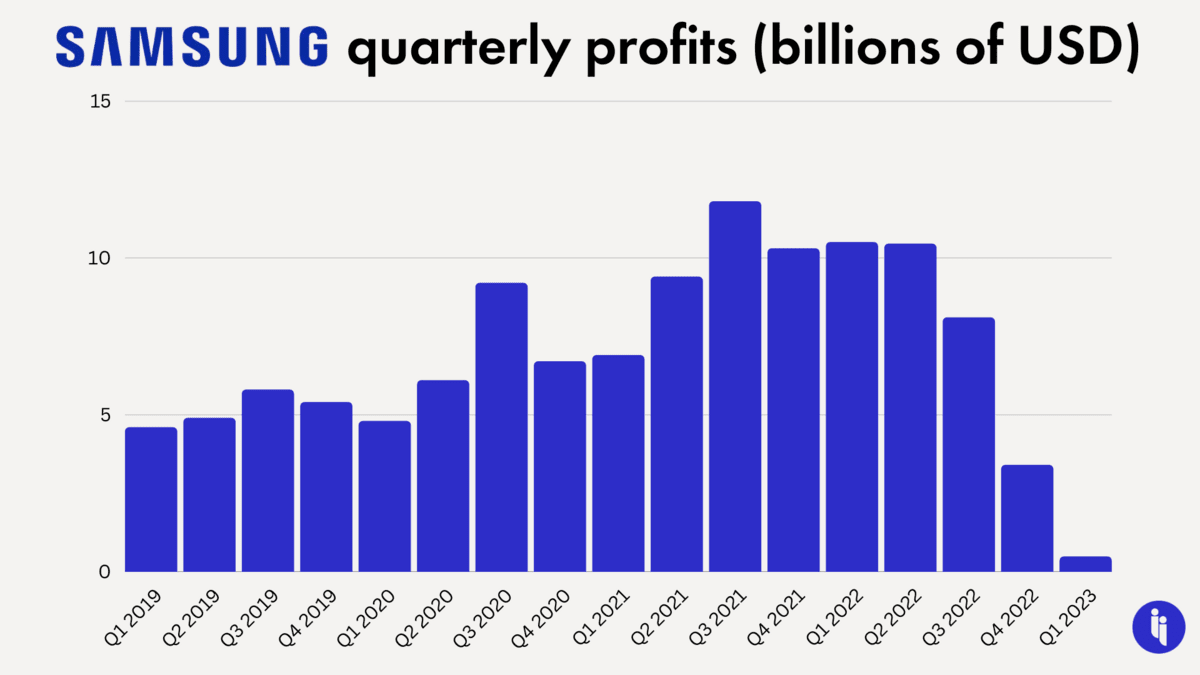

Briefly: South Korean electronics giant Samsung has seen a 95% drop in profit this year, hitting its lowest quarterly earnings since 2009.

Samsung enjoyed record profits in recent years as pandemic lockdowns drove folks to buy more gadgets. But that demand has collapsed now that the lockdowns have lifted, inflation has spiked, and interest rates have jumped.

Intrigue’s take: 95% is a high number for any company, let alone the world’s largest memory chip supplier. It’s higher than Snoop Dogg on April 20th.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

Slower demand is one part of the story, but the emerging chip wars may be warping the supply side too, as governments around the world offer incentives to shore up their own chip-making capabilities. So something tells us Samsung won’t be the only chip-maker to face wonky earnings reports ahead.

Also worth noting:

- Two of Samsung’s smaller competitors posted big losses recently.

- The US has asked South Korea not to fill any market gap in China if Beijing goes ahead with a ban on American chip-maker, Micron.