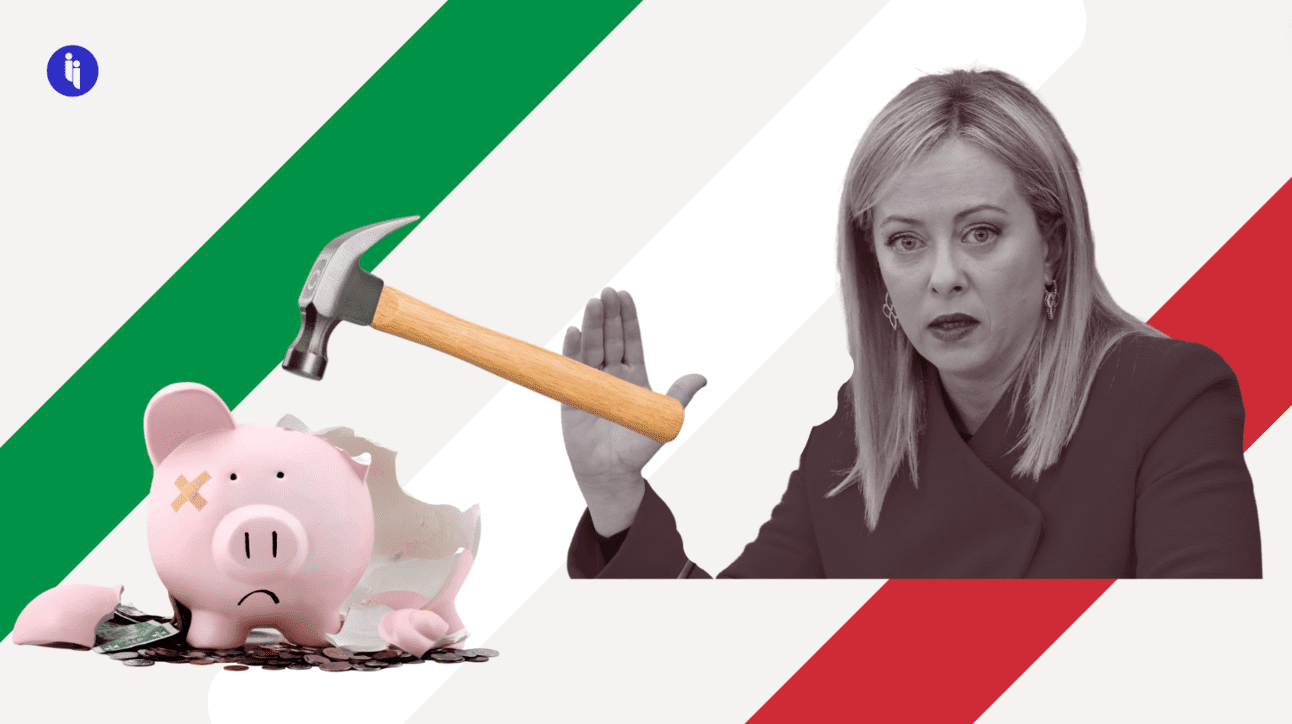

Italian bank shares slid on Tuesday (yesterday) in response to a surprise new one-off 40% tax on “excess” bank profits.

It’s been a turbulent year in the global financial system. Three US banks failed in five days, and Credit Suisse was gobbled up via emergency sale.

For other banks, though, times have been pretty good: higher interest rates mean they’ve charged more on loans, but they haven’t passed the higher rates on to savers. This gap (the ‘net interest margin’) has generated billions in profit.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

So, Italy’s populist government is taking a slice with its new tax, hinting it’ll introduce cost-of-living relief in return.

Interestingly, though, Rome partly hit ctrl-z on the tax overnight (Tuesday) to calm spooked markets, saying it’ll cap the measure at 0.1% of bank assets.

Intrigue’s take: A couple of things come to mind here.

First, banks all over are in this grey zone where they’re privately owned but perform a very public role. So sure, they might get bailed out when times get tough. But governments might come knocking when times are good.

And second, Rome’s move may well trigger a bump in government revenue and approval ratings. But there’ll be a real hit to investor confidence, too. And these hits tend to last longer than any electoral or budgetary cycle.

Also worth noting:

- Italy’s parliament now has 60 days to approve the measure.

- Other European governments, including Spain and Hungary, have introduced windfall taxes on their banking sectors in the past year.

- Earlier on Monday, rating agency Moody’s downgraded the credit ratings of a range of small and mid-sized U.S. banks.