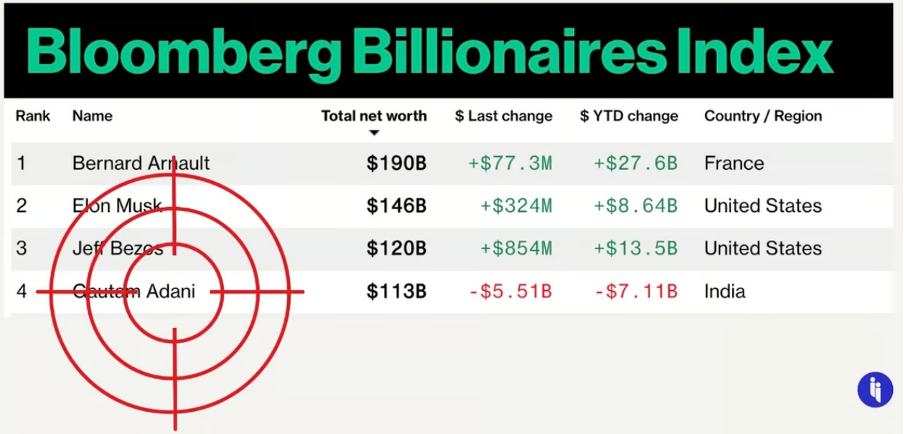

Briefly: It’s been a tough week for Gautam Adani, the tycoon at the helm of India’s largest conglomerate. On Wednesday (25 January), activist investor firm Hindenburg Research* accused his company of “pulling the largest con in corporate history“, leading traders to sell large volumes of stocks (Adani fell to fourth on the list of world’s wealthiest people 😣).

The report claims that the Adani Group has engaged in stock manipulation and accounting fraud for decades, in addition to operating a labyrinth of shell companies and working diligently to silence critics.

Adani Group has denied the allegations and labelled the report a “malicious combination of selective misinformation”.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 115,000+ subscribers

No spam. No noise. Unsubscribe any time.

Some context: Adani Group isn’t any old conglomerate. It controls leading businesses in vital Indian industries – agriculture, infrastructure, energy, and defence – and has close ties to India’s PM (Gautam Adani is sometimes referred to as ‘Modi’s Rockefeller’).

The market angle: This scandal may prove a pivotal moment for the Indian economy. As Bloomberg columnist Andy Mukherjee explains, Hindenburg’s report “raises many questions about the integrity of the broader Indian market, which is caught between the pressures of financial globalization and political nationalism.”

Intrigue’s take: The links between Adani, his empire, and Indian Prime Minister Narendra Modi are difficult to deny. Since Modi came into office, Adani’s net worth has grown 60x, thanks in part to lucrative government contracts. To date, the two powerful men have enjoyed a mutually-beneficial relationship. But if the allegations are confirmed, Modi’s opposition will surely use them as ammunition ahead of next year’s general election.

Also worth noting:

- Narendra Modi boasts an approval rating over 70% as of January 2023.

- Companies targeted by Hindenburg Research investigations have seen their stocks decline by 26% (on average) within six months after being named and shamed.

*Hindenburg Research is indeed named after the Hindenburg blimp disaster of 1937. Very apt and yet a little unsettling.