We’re normally pretty suspicious of anyone who substitutes their ‘s’ with a ‘z’ to look cool, but we’ll give the UK-based ‘Kantar BrandZ Report 2024’ a pass (or is it ‘pasz’?).

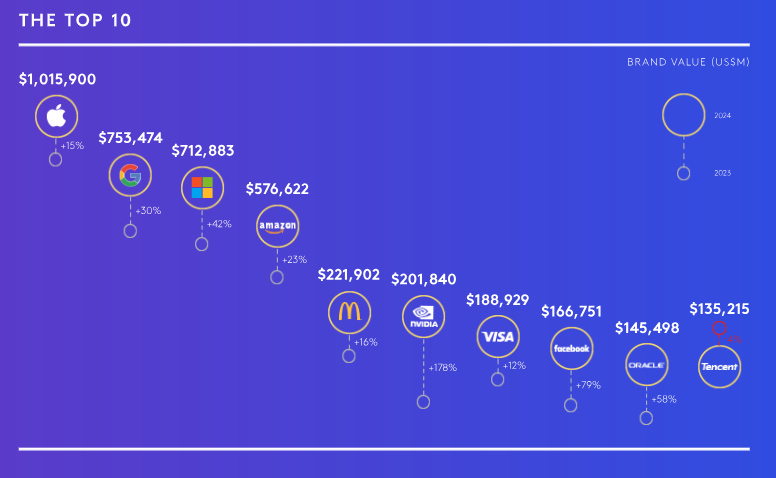

Kantar, a market research agency, publishes an annual report ranking companies by their brand value (i.e. how much a brand contributes to the overall value of its parent company) as opposed to that company’s hard assets or total market cap.

Intrigued, we dug a little deeper.

Stay on top of your world from inside your inbox.

Subscribe for free today and receive way much more insights.

Trusted by 114,000+ subscribers

No spam. No noise. Unsubscribe any time.

So here are five of the top 10 most valuable brands worldwide, and some of the main geopolitical headwinds they and their parent companies face today:

Apple (ranked #1 at $1.02T)

- US-China ties – Apple’s ‘Designed in California assembled in China’ needs no introduction. But as US-China rivalry heats up, companies (especially tech ones) risk getting caught in the crossfire. That’s why a smiling Tim Cook led a delegation of US CEOs to meet Xi Jinping earlier this year, but also why a smiling Tim Cook has been calling on leaders in Vietnam, Indonesia and elsewhere: you gotta diversify.

- Competition -China is Apple’s third-largest market but Apple has lost its top spot there this year, with local iPhone sales down 19% in Q1. It’s partly due to stiff competition from local rivals offering solid products at better prices to spendthrift consumers. So Apple has cut its own prices to lure customers back, but that might not be enough: some folks in China now simply prefer to buy from a national champion.

Amazon (ranked #4 at $577B)

- Trade chokepoints – When you build a brand on your ability to deliver a Steve Buscemi pillowcase in eight hours, supply chains can become a major brand risk. And despite deploying robots, chartering ships, and building out a fleet of 85 aircraft, Covid-era Amazon still delivered more ‘out-of-stock’ alerts, higher prices, and lower profits. So supply chains are hard, and made harder by factors like drought across the Panama Canal and Houthis along the Red Sea.

- Suppliers – Amazon has also deployed blockchain and IoT to better track and trace across its supply chain, but there are still reports of, say, tomato pastes made with Xinjiang forced labour slipping through.

- Government partnerships – Amazon (with Google) also won Israel’s ‘Project Nimbus’ tender last August to help transition the government onto the cloud. But critics highlight that the beneficiaries include Israel’s military, which continues to generate controversy over its war in Gaza. Amazon has (like other tech giants) also copped criticism for bowing to censorship policies imposed by states like China and the UAE.

McDonald’s (ranked #5 at $223B)

- Boycotts – There are 42,000 McDonald’s stores across 120 countries, and around 93% of them are owned by local franchisees. But it’s an American brand, and recent Israel boycotts have highlighted the risks this can now entail. But as an inverse reminder of the brand’s power, look at what happens when McDonalds isn’t present: you still get ‘Mash Donalds’ in Iran, ‘Big Hit’ (Big Mac) in Russia, and ‘McDunalds’ in Cuba (there’s also a real McDonalds in Guantanamo Bay but that’s another story).

- Environment – Many have warned about extreme weather events and changes in our climate, but McDonald’s customers in Asia have already had a taste: floods in Canada triggered a historic drop in potato yields and – combined with Covid chaos – caused stores in Japan, Malaysia and Indonesia to pull large-sized french fries from their menus in 2022.

Visa (ranked #7 at $189B)

- Sanctions – Just when you think the global business environment couldn’t get any trickier, Russia invades its neighbour and triggers retaliatory sanctions. So Visa has duly blocked international transactions from Russian Visa cards and is booting Russian entities from its systems to comply with US and EU sanctions. But it’s been interesting to watch local payment rivals seek to fill the gap, as China, Russia, and others try to insulate themselves against this kind of US firepower.

Tencent (ranked #10 at $135B)

- Regulatoooooors -The only non-US brand to make this particular UK-based list, Tencent owns China’s super-app (WeChat), is the world’s largest video game publisher (with stakes in hits like Fortnite), and also owns a fifth of Universal Music (which publishes everyone from Warren G to Taylor Swift). But with so much of its business online, it’s vulnerable to new regulatory scrutiny at home and abroad. Eg, Beijing hit it with a surprise video game crackdown in 2021, and Tencent built one of the world’s largest AI chip stockpiles ahead of US export controls last year. It’s now hoping it can switch to domestic chips without losing its edge.

And this is just the tiniest snapshot of global brandz (😎), and the ways they now bump up against this wild world of ours.

INTRIGUE’S TAKE

So what’s a brand to do? Heck, what’s a consumer to do?

There’s a natural temptation for more consumers to turn inwards and buy local, which is certainly a viable option for some products, like if you live in Florida and want to pick up some oranges. But those oranges likely grew with a little help from ammonium sulphate, which is produced in the US, though not enough to meet demand (US imports hit a new record in March).

Likewise, there’s a natural temptation for more companies to pull up the drawbridge and focus on their home markets. And that’s a viable option if you’re, say, a Czech microbrewery serving one of the beer halls in Prague. But while the Czechs produce their own barley, hops, yeast, water, and even beer bottles, those darn bottles need silica, and the Czechs don’t make enough.

So these local urges are noble, but eventually many will bump up against global realities of some kind. And so the winners in that world will be those who figure out how to harness a global reach, but in a way that respects local tastes and regulations, caters to those yearnings for authentic connections, but while somehow also hedging against supply risks.

That sounds hard, but it might look like more decentralisation and localisation for some global brands, but for others, more accumulation and conglomeration of local brands under an arms-length HQ.

It’s riches in niches (which only rhymes for Americans).